ACA Compliance Audit

Simply upload the 1095-C PDF forms, and our software will provide a customized report identifying invalid IRS code combinations. No messy data or formatting is required.

IRS & ACA Compliance

Are Your 1095-C Forms Correct?

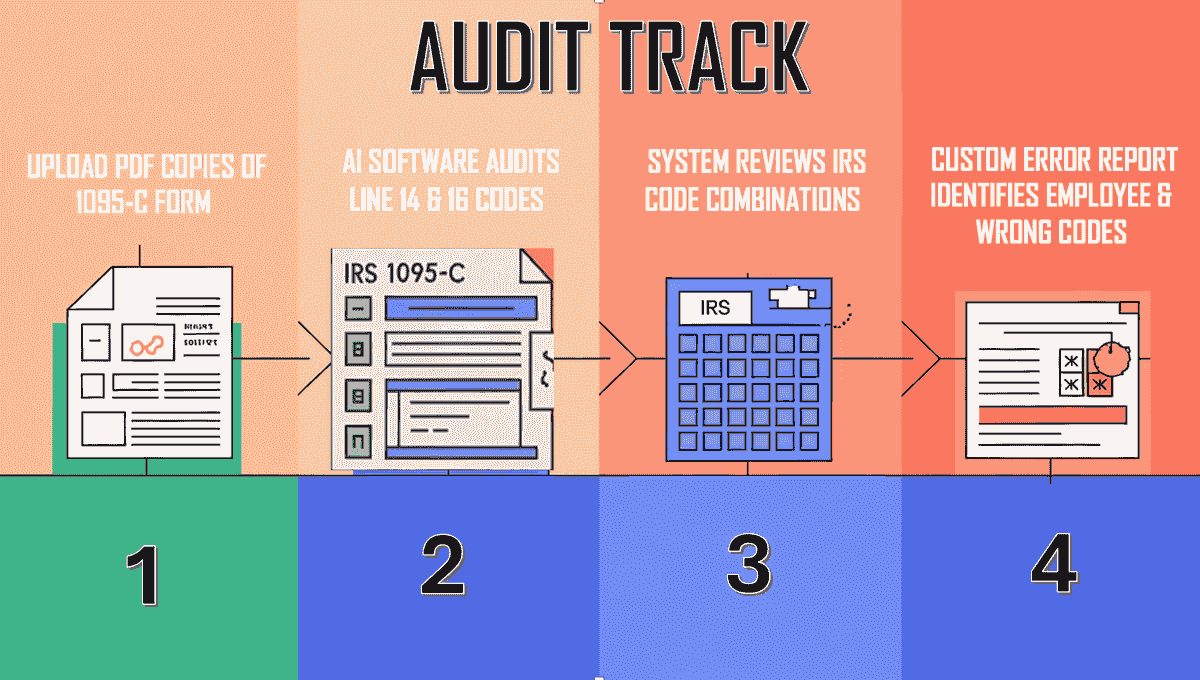

AUDIT TRACK

Powered By ACA TRACK.NET

1095-C AUDIT

Simply Upload The PDF Copy | Get Same Day Results

AUDIT TRACK has developed revolutionary Machine Learning (ML) technology that will review copies of your IRS 1095 PDF forms and identify invalid IRS code combinations on Lines 14 & 16.

Why This Matters

"An employer may contract with a third party to file returns and furnish statements to employees. However, entering into a contract with a third party does not transfer the employer's liability for the failure to file correct returns and furnish correct statements. The employer remains responsible for any penalties resulting from errors or omissions."

(Source: IRS Instructions for Forms 1094-C and 1095-C, Responsibility of Employer)

IRS Penalties and Recoveries

If the IRS detects errors in Lines 14 or 16, it could result in hefty penalties. The ACA requires accurate tracking of employee healthcare coverage to determine if an Applicable Large Employer (ALE) has met the coverage requirements. Misreporting, especially on these lines, could lead to penalties ranging from $280 per form up to $3.4 million annually for a large business.

Staying Ahead of the IRS

Catching mistakes before the IRS does can save your company significant time and money. Our audit tool allows you to proactively address potential issues in your ACA filings, minimizing the risk of penalties, costly audits, and unnecessary fines.

Compliance and Accuracy

Ensure that correct coding on lines 14 and 16 is critical because it determines whether your business provided the required coverage and whether employees qualified for an exemption or a subsidy. Incorrect filings can lead to overpayments or underpayments, both of which can affect your company’s bottom line and compliance status.

© 2019